Home -›

POS -› Multiple Tax Rates

How to configure the tax groups:

How to configure the tax groups:

SplitAbility point of sale supports multiple tax rates through the addition of groups. Groups can also be used to handle group discounts, promotions or daily specials.

Groups can also be used to calculate "Food Costs", a key metric for determining profitability.

A simple store wide tax is one set up option but for multiple tax rates across various items you’ll need to use groups.

Inclusive, exclusive and compound tax rates are supported. Compound taxes are also known as stacked taxes or tax on taxes.

Any number of groups may be added, different rates can be applied to any group. Individual items can have their own tax groups applied to them. Groups may be applied or removed to menu items in the POS with one simple action.

Some sample prints of various tax receipts:

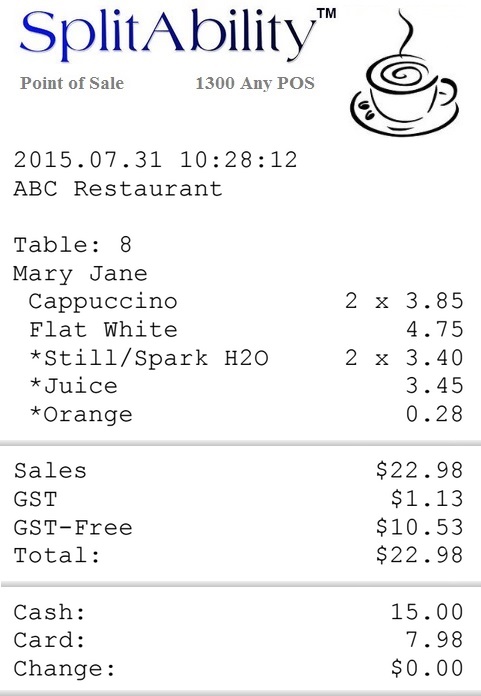

A coffee shop in Sydney sells GST & GST-Free items:

Groups can also be used to calculate "Food Costs", a key metric for determining profitability.

A simple store wide tax is one set up option but for multiple tax rates across various items you’ll need to use groups.

Inclusive, exclusive and compound tax rates are supported. Compound taxes are also known as stacked taxes or tax on taxes.

Any number of groups may be added, different rates can be applied to any group. Individual items can have their own tax groups applied to them. Groups may be applied or removed to menu items in the POS with one simple action.

Some sample prints of various tax receipts:

A coffee shop in Sydney sells GST & GST-Free items:

|

| GST tax items shown on a customer receipt GST-Free items are tagged with a "*" |

|

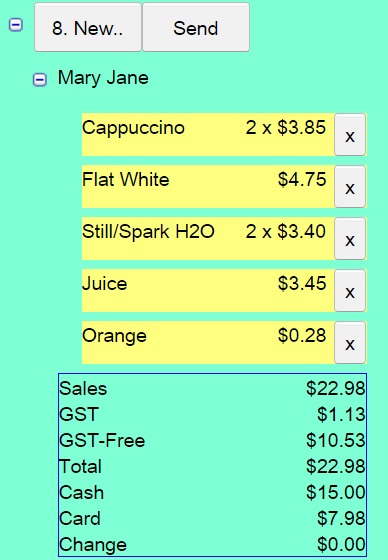

| The POS screen view |

How to configure the tax groups:

|

| Step 1. Add group/s to menu items. |

|

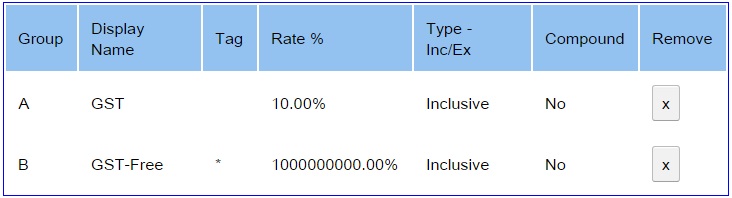

| Step 2. Set the group details in the POS Settings - Admin - Taxes. |

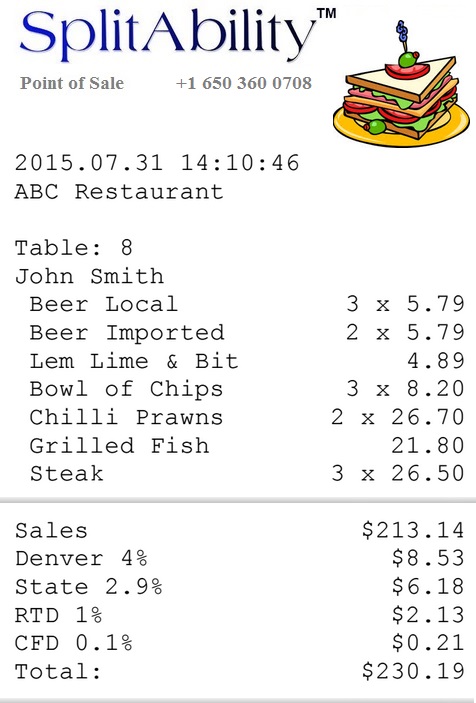

A restaurant in metropolitan Denver Colorado shows taxes totaling 8.00%

The restaurant wishes to show all taxes on the receipt.

E.g.

The restaurant wishes to show all taxes on the receipt.

E.g.

4.00% Denver

2.90% State

1.00% RTD

.10% Cultural Facilities District

2.90% State

1.00% RTD

.10% Cultural Facilities District

|

| USA style sales taxes Customer receipt, without tagged items. |

|

| The POS screen view |

How to configure the tax groups:

|

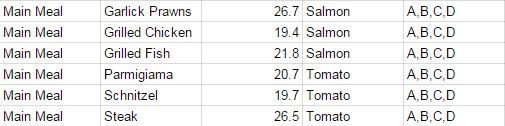

| Step 1. Add group/s to menu items. |

|

| Step 2. Set the group details in the POS Settings - Admin - Taxes. |

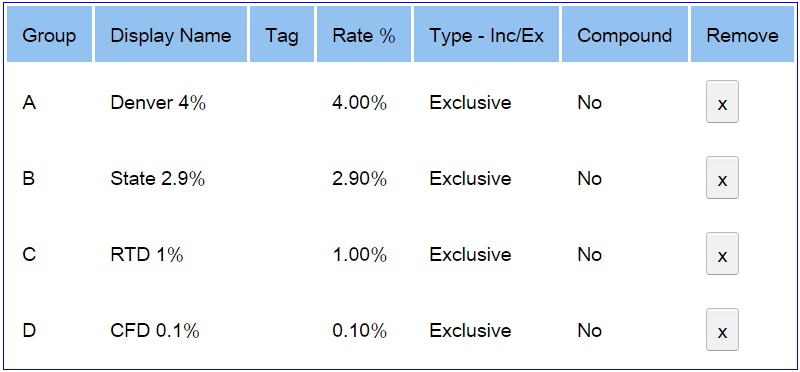

Add the group details in Settings - Admin - Tax - Groups:

- Display name - shown on the total and receipt print.

- Tag – shown on all items in the group.

- Rate (+) for charges or taxes and (-) for discounts/promotions.

- Inclusive or Exclusive.

- Compound or non compound.